Why brand equity matters in sponsorship, and how to create a positive virtuous cycle over time.

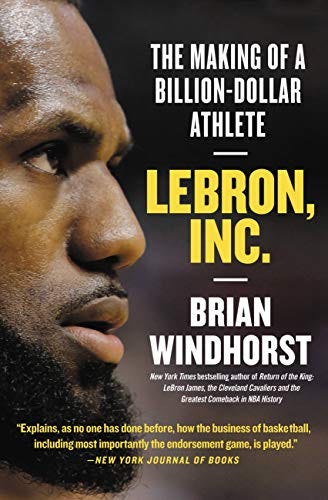

Nike x Lebron case study

In 2003 at the age of 18, LeBron was approached by Nike, Adidas and Reebok for sponsorship deals. The reported offers over 10 years were:

- Reebok: $115M

- Nike: $90M

- Adidas: $60M

Nike could’ve afforded to match the Reebok offer, but they chose not to. Reebok had the highest offer by a mile, but LeBron still chose Nike.

Q: Why?

A: Nike’s brand equity.

Brand equity…

A key benefit of establishing brand equity is the impact it can have on ROI. A consumer may seek out, and select one brand over another, not necessary based on price, but based on their perception of the brand. This allows brands to generate greater revenue by charging premium prices compared to their competitors, often whilst spending less on things like production, advertising… and sponsorship.

Brand equity isn’t only a competitive advantage when selling to consumers, it can also be highly beneficial when negotiating sponsorship deals.

The concept of brand equity isn’t only relevant to the B2C relationship, and as the example of LeBron x Nike shows, it also applies to B2B, including sponsorship deals.

In sports sponsorship, properties are like real estate, but different.

With real estate, the property will always be sold to the highest bidder. A lot of the time, this is the case with sport sponsorship, but not always. The brand equity and public perception of the sponsor can 1) impact who the rights-holder chooses to partner with, and 2) the sponsorship fee amount. Here’s how it played out with LeBron…

The Nike brand was thriving in 2003, allowing them to capitalise and secure LeBron (at what could be argued as a discount).

Built around his super-human ability to dunk, arguably the most iconic sponsorship deal of all time was made in 1984 – Michael Jordan x Nike. As part of this deal, a new sneaker was launched every season and by 2003, Nike were thriving off the back of the Air Jordan brand. Thanks to Jordan’s legacy and Nike’s superior branding, LeBron visualised his future with Nike, and wanted to become part of the “Nike family”. He dreamt about being in Nike commercials and wanted to be like Jordan. So he signed with Nike, for less.

Less attractive brands need to pay a premium

Reebok offered $115M and still weren’t able to secure LeBron because he clearly saw them as less superior, but there is a likelihood that a high-enough dollar amount would’ve served as a tipping point, making it irrational for LeBron to neglect Reebok’s offer… What was this tipping point? $150M? We’ll never know.

The premium required for less attractive brands is on a scale

Reebok’s requirement to pay a premium is not a rare phenomenon in sponsorship, and it applies to many other global brands from common categories such as alcohol, wagering and fast food. Some others from the energy and crytpo categories are beginning to feel the same stigma.

How the Nike x LeBron deal turned into a positive, virtuous cycle of brand equity, sales and revenue…

Since 2003, Lebron and Nike have both benefited from a large value exchange that has contributed to their exponential growth in brand and revenue.

Nike x LeBron: Sponsor, build brand, sell. Repeat.

In exchange for a sizeable sponsorship fee, LeBron has provided his endorsement and IP to Nike to help them sell shoes and apparel. The association to LeBron builds Nike’s brand equity and creates greater demand for Nike products which fuels their revenue, and their ability to sponsor LeBron for greater amounts in the future. How do we know this? - The Undefeated has reported that LeBron’s overall signature business, including shoes, apparel and accessories, is estimated to generate Nike around $600 million annually. In return, in 2015 LeBron struck a lifetime agreement with Nike that pays him 10’s of millions annually, a deal apparently worth north of $1 billion.

The virtuous cycle can also track downwards

On the flipside, post LeBron accepting Nike’s offer in 2003, it became public knowledge that Reebok had the highest bid and still lost, and as a result their stock dipped. Not long after, Reebok was bought by Adidas in 2005, and posted lower revenue than it did in 1990. Nike’s market cap of $136 billion at the time was three times the size of Adidas.

Reebok’s sliding-doors moment

What impact would’ve securing LeBron in 2003 had on Reebok’s future brand growth and revenue streams? Did they miss the chance to create exponential growth by creating a virtuous cycle in partnership LeBron? We’ll never know.