Revenue from wagering flows into sports in ways that will surprise you

Wagerer’s pay eye-watering sums of money to partner with sports in order to generate commercial returns.

This often creates a major ethical dilemma for sports teams and leagues because sporting organisations are increasingly under pressure to limit and/or remove their exposure to sports betting.

Although this is the case, sports betting remains prominent across many codes and this is due to the staggering amounts of money on offer, creating a scenario that makes it too difficult for sports to turn away from.

*This is not an article aimed at highlighting the positive and negative effects of wagering, it’s purely highlighting the massive amounts of money that are flowing into sports in unexpected ways, and sports’ growing dependence on it.

Australian sports betting companies are raking in huge sums of money

Most wagering companies are registered in the Northern Territory for tax minimisation purposes and the NT regulator estimates that most companies have annual turnover of $52b.

Sports are beneficiaries of the lucrative sports betting category

To generate such huge annual turnover, a variety of mutually-beneficial commercial deals are in place to promote sports betting with sports organisations, and as a result sports are underpinned by wagering dollars in more ways than you think…

Revenue stream 1: Traditional Sponsorship

The most obvious revenue driver is sponsorship. Traditional sports sponsorships can be useful for brand building and driving fans to the point of sale.

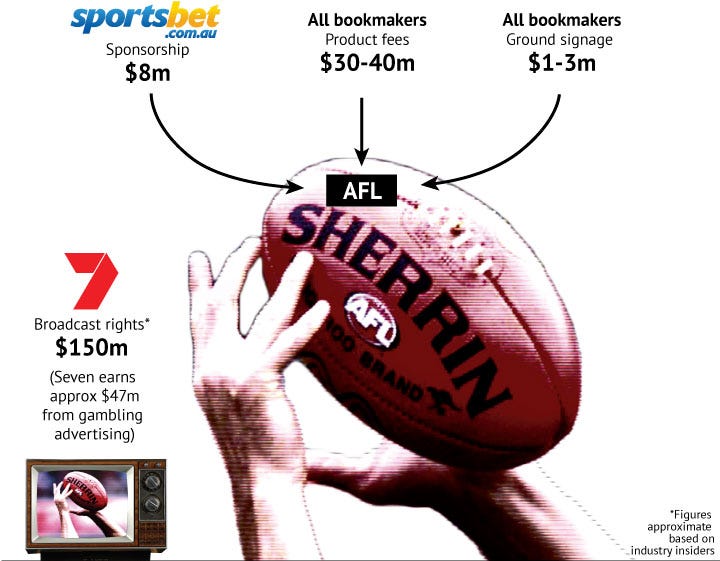

Sportsbet sponsors the AFL and NRL

Sportsbet are the major sponsors of both the AFL and NRL and activate their sponsorships to encourage fans to bet using special promotions and targeted advertising on broadcast and digital media, driving fans to their betslip.

Crown Resorts have recently approached AFL teams for new sponsorships

The ABC reported that ahead of the 2023 AFL season, Crown Resorts were offering large sponsorship deals to multiple Victorian AFL clubs, encouraging them to abandon a pledge not to accept money from gambling companies.

Revenue stream 2: Broadcast

The major codes in Australia have multi-billion dollar deals with broadcasters and media who receive large amounts of ad revenue from the sports betting companies that place their ads strategically around sport.

Gambling advertising spend in Australia, 2021

Total: $287m

Television: $179m

Digital platforms: $54m

Radio: $25m

Reference: AFR

The more dollars the broadcasters are able to recoup from their rights fee through wagering advertising, the greater the power they have to renew their sports rights when the time comes around, resulting in increased revenue for rights-holders such as the NRL and AFL.

The cycle repeats.

Revenue Stream 3: Product fee’s (The most lucrative of them all)

The product fee deal is a common and extremely lucrative revenue stream, but one that’s rarely spoken about by senior executives, and one that is not commonly known by fans.

Click the video below to view Gillon McLachlan explaining how the product fee works.

The product fee arrangement enables sporting organisations to receive a cut of gambling turnover on its matches, beyond traditional sponsorship deals. It works much like a tax.

Many sporting codes have product fee deals in place with wagerer’s in Australia, placing them in a position where they’re directly profiting from the proceeds of gambling.

Matt Tripp is the Melbourne Storm chairman and a gambling industry veteran who sold his stake in BetEasy in 2019 in a $250m deal, and now runs Newscorp-affiliated gambling company Betr. He has previously stated that wagering is:

“The engine beneath the might of the AFL”

Evidence of this has been showcased by The Age, who has reported that the AFL received $30m -$40m in 2022 through its product fee deals. This is in addition to sponsorships, and other revenue streams.

Currently, the NRL generates around $50m annually from wagering operators in Australia.

Rugby League is a somewhat outlier from other codes as they have resisted the backlash around wagering more than others, by announcing new deals and upgrading existing ones. The ABC has reported that approximately half of the NRL competition have prominent partnerships with gambling entities.

With a trip to Vegas on the cards, the NRL’s wagering revenue is set to expand.

The NRL wants to open next year’s competition with a double-header in Las Vegas at the state of the art Allegiant Stadium, the home of next year's Super Bowl, and this ambition is motivated by HUGE wagering dollars that are up for grabs.

Sports betting is exploding in the US and the NRL wants a piece of the sports betting pie.

In 2018, the US Supreme Court granted states the individual power to legalise sports betting. Fast forward to now, 36 states have now legalised it, and others are currently in debate to follow suit.

$180.2b (USD) has been legally wagered on sports in the US since 2018.

46m people in the US planned to make a bet in the most recent NFL season, more than Australia's entire population.

How will the NRL generate revenue from their trip to Vegas?

The NRL would provide US sports betting agencies with the rights to show live content and bet, in exchange for a product fee.

“If the American public sees it, they will bet on it.” - Matt Tripp

The NRL have made numerous failed-attempts to expand into the US, but the landscape has changed over the years and the lucrative US sports betting market may serve as the tipping point to make it happen.

Some experts are concerned about sports’ increasing dependency on gambling revenue.

Due to calls from the community, politicians, health professionals, players and gambling addicts, NRL chief executive Andrew Abdo and his AFL counterpart Gillon McLachlan have faced a government inquiry recently and the government is considering crackdown on the category.

On the flipside others argue that wagering can have a positive impact, and that wagering:

Is a superior fan engagement tool, keeping viewers engaged in sports they otherwise wouldn’t engage in

Is a net positive for local economies - punters show up to bars to watch games

Delivers revenue that supports game development initiatives and the growth of women’s sports

Betting on the wrong tactics

Either way, if Australia is wanting to reduce the prevalence of gambling in Australia, we’re going the wrong way about it. According to marketing experts, some anti-gambling campaigns are having the opposite effect.

Whether sports betting is good or bad, it is a major revenue driver for sports, and sports are profiting off this category in more ways that meet the eye.